After the 1.1 billion yuan "advertising door", BYD still has a big alarm.

After 1.1 billion yuan of "advertising door",There is also a big alarm.

BYD has always been regarded by many people as the leader of domestic new energy vehicles and the spokesperson of domestic independent brands. In just five years after listing, the operating income reached 100 billion yuan. However, with the release of the 2017 annual report and the first quarter report of 2018, it shows that BYD’s operating conditions are not optimistic. This paper discusses and analyzes BYD’s operating conditions from the financial point of view.

Affected by the decline in subsidies for new energy vehicles, BYD’s net profit in 2017 fell by 19.5% year-on-year, and its net profit in the first quarter of 2018 plummeted by 83.1% year-on-year. And in a quarterly report, it is estimated that the net profit attributable to shareholders of listed companies will drop by 82.59% to 70.98% from January to June this year.

The 1.1 billion "advertising door" incident in July this year pushed BYD to the forefront of public opinion. Some critics outside believe that such an incident has exposed some problems in BYD’s management. Will management problems have an impact on the company’s business? We can observe its real operating ability and financial situation by analyzing its financial statements.

The difficulty of profitability and growth ability

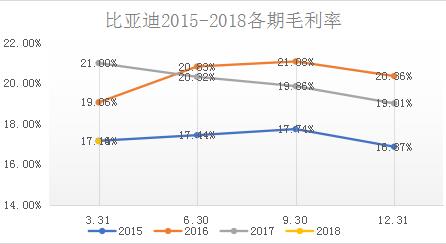

Table 1 BYD’s gross profit margin in 2015-2018

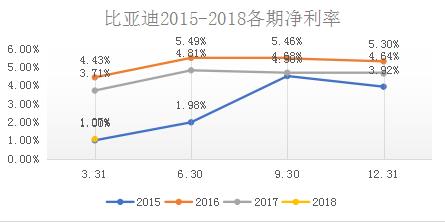

Table 2 BYD’s net interest rate in each period from 2015 to 2018

As can be seen from the chart comparison, although BYD’s gross profit margin has declined slightly in recent years, it is still relatively stable, but the net profit rate has generally declined since 2017, reaching 1.07% in the first quarter of 2018, down 71.16% year-on-year. At the same time, according to the 2017 annual report, although BYD’s operating income increased by 2.36% year-on-year, its net profit returned to its mother decreased by -19.51% year-on-year, and its non-net profit decreased by 35%. Then we will horizontally analyze the results of BYD’s main business income and gross profit margin in 2017 compared with the same industry to determine the reasons for the decrease in profits. BYD’s main business is mobile phone parts and assembly, automobiles and related products, rechargeable batteries and photovoltaics. We take Foxconn, Beiqi New Energy,For comparison.

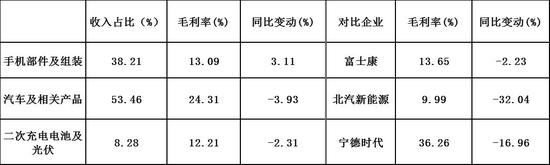

Table 3 Comparison of gross profit margin and changes of BYD’s main businesses with the same industry in 2017

It can be concluded that the yield of BYD’s mobile phone sector and assembly industry is good, but the yield of automobile industry and battery and photovoltaic industry is worrying.

On the whole, there are four reasons.

First, the state subsidies for new energy vehicles have fallen sharply. In 2017, the subsidies for new energy vehicles fell by about 20%, which directly led to the decline of the company’s performance. If the new energy policy continues, this unfavorable factor will continue.

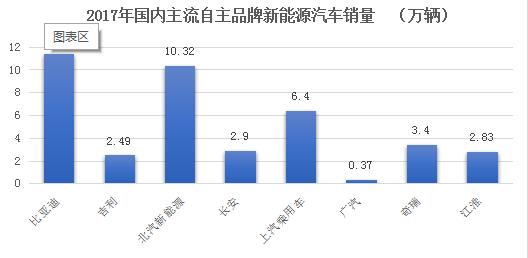

Second, industry competition has intensified. I am in 2017The total sales volume of automobiles in the whole year was 777,000, and all major automobile companies showed strong interest in the field of new energy vehicles, such as established BAIC, GAC and SAIC, and emerging Weilai and Tucki, which doubled the pressure on BYD. And in 2018, joint venture brands also began to enter the market, and BYD will face more intense competition.

Thirdly, BYD’s power battery industry is under great technical pressure. At the same time, it has been suppressed by Contemporary Amperex Technology Co., Limited, and its battery sales have been surpassed.

Fourth, considering the cost, the prices of the four core raw materials for manufacturing batteries have risen steadily, which has greatly reduced BYD’s battery profits. It is predicted that if these four problems can’t be solved in time or enterprises can’t find another way in the future, BYD’s profitability and growth ability will continue to decline.

Table 4 Sales volume of domestic mainstream independent brand new energy vehicles in 2017

Pressure of debt repayment

Table 5 BYD in 2015-2017,、Solvency index

Comparing BYD with two companies in the same industry, it is found that BYD’s solvency is significantly lower than that of the other two companies, which deserves our attention. In particular, the quick ratio and cash ratio are far lower than those in the same industry, which shows that there are risks in the short-term solvency of enterprises, and cash and cash equivalents are difficult to repay the current liabilities borne by enterprises. At the same time, it also proves that BYD’s accounts receivable and inventory are relatively high in the same industry. Then let’s analyze the status of BYD’s inventory, accounts receivable and prepayments.

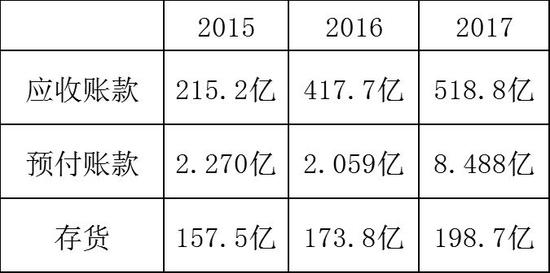

Table 6 Changes of BYD’s inventory, accounts receivable and prepayments in 2015-2017

BYD’s accounts receivable increased by 24.20%, prepayments increased by 312.24%, and inventory increased by 14.32%, which was amazing. These data potentially show that BYD does not hesitate to sell on credit in order to expand the market and improve its competitiveness. At the same time, its bargaining power has begun to weaken in the face of suppliers. Excessive inventory also affects the turnover efficiency of enterprises and increases the occupation of funds. All these situations are warning the increasing financial pressure of enterprises.

Operational capacity that needs to be improved urgently

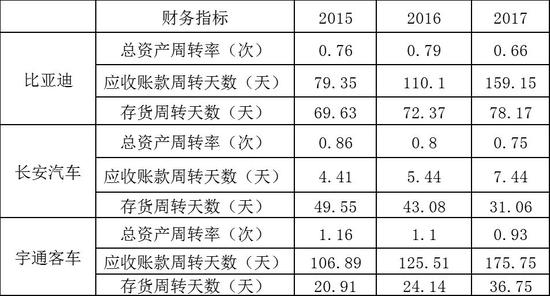

Table 7 Operating Capacity Indicators of BYD, Changan Automobile and Yutong Bus in 2015-2017

The data shows that BYD is also under pressure compared with its peers in terms of operational capacity. Compared with the industry, BYD’s inventory turnover days, total assets turnover rate and average collection period are weak. In 2017, average collection period is even 21 times that of Changan Automobile, while the inventory turnover days are about 4 times that of Yutong Bus, which reflects the poor liquidity of enterprises and highlights the urgent need for improvement in their current assets management.

The core reason why the 1.1 billion "advertising door" incident has had such a great impact on BYD is that once this incident is settled, BYD needs to bear part of the responsibility, which is undoubtedly unbearable for investors. After all, BYD’s net profit in the first quarter of this year was only 102 million yuan.

No matter from the "advertising door" incident or the above analysis of BYD’s operation from the financial indicators, they all sounded the alarm for BYD’s management. As a leader in energy vehicles, it needs perfect corporate governance, and more importantly, it needs excellent results to repay investors. Otherwise, investors will vote with their feet.